The number one rule of wealth management is “Know where your money is going.” Don’t look it up, it’s an unwritten rule.

Everybody knows how much money is coming in every month. They just have to look at their paychecks. But not everybody knows where all of that money is going. Sure, they know about the big bills: rent/mortgage, student loan, car payment, utilities, phone, etc., but many don’t remember at the end of the month what they spent at the beginning of the month.

This causes them to always ask, “Where the hell did my money go?”

I certainly was one of these people. Every month I used to ask myself the same two questions. The question above and “What did I buy this month?”

I was really fed up with that routine so I decided to write down every single expense I made… I mean EVERYTHING. After a month I looked back at my spending and was able to figure out where my money was really going.

Keeping track of my spending helped me understand my spending habits and made me see the areas in which I was just throwing money away. I was then able to change my ways and I now can see a path towards financial independence in a not so distant future.

Tracking your spending is not hard at all. You just have to do it. And the good thing is there are many different ways you could track your spending. There is not just ONE correct way, you just have to find the one that’s right for you.

How To Track Your Spending

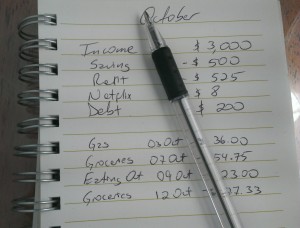

Good Old Pen and Paper – This is probably the way most people know how to do it. Just get an old fashioned composition notebook, write down your income and start subtracting the expenses. All of the expenses – down to the penny. Gather all your bills and write them down: cable, cellphone, car, credit cards, gym memberships, Netflix, mortgage, heat, gas (home and car). I mean ALL YOUR BILLS.

But wait, there’s more! Every time you buy something, write it down. It doesn’t matter how insignificant of a purchase you might think it is. Just write it down. At least for the first few months or until you have a hold on your expenses.

Carry that notebook wherever you go. Don’t try to keep the expenses in your head so you can write them down when you get home. Write them down right away or you’ll forget to do it later. Trust me, I’ve done it way too many times.

Spreadsheet – You can also keep track of your spending by using spreadsheets. This is one of my methods of choice because once you create them, you just copy them for the next month. And you don’t need to keep doing math – as long as you do the formulas right.

If you don’t know how to make your own, don’t worry. You can find hundreds of free spreadsheets by doing a web search. You can also check out vertex42.com, they have a lot of free templates you can download.

Computer Software – There are plenty of computer programs you could use, but my favorite is Mint. Mint is a free program/website that helps you budget, track your spending, set financial goals, and much more. You can sync all your accounts and have all that information in one place – bank account, investments, loans, etc.

What I like about Mint is that it is free!

Okay, I have to admit that I don’t use Mint anymore because I’m more of a spreadsheet type of guy and I like to write down all my expenses myself. I know Mint is easier, but that’s just me… I’m weird like that. But I highly recommend Mint if you haven’t found something that works for you.

Mobile Apps – We live in the age of technology in which our smart phones can do a whole lot more than just make phone calls. With our smart phones we can listen to music, take pictures, record video, record voice messages, take notes, browse the internet, send and receive emails, play games, watch movies, etc. You know what else it can do? Track your spending.

There are countless apps that allow you to track your spending without having to carry a notebook and a pen. Carrying a notebook everywhere you go might be doable for the ladies who like to carry big purses, but it is not doable for me.

What’s up with those big purses anyways? You could carry at least two kids in some of them. How many things do you really need to carry around at all times? I don’t have that many items in my car… and it has wheels and a trunk. I digress.

Most people carry their phones everywhere they go and it is really simple to just open up an app and type in your expenses as they happen. Some apps sync automatically with your accounts, but others are just for you to write things down and then enter them in your notebook or your spreadsheet when you get home.

I used an app called GoodBudget, which works like an envelope system. You add virtual money to it – based on your budget – and it subtracts your expenses and lets you know how much money you have left to spend. They have a free plan and a paid plan. I use the free plan because it takes care of all my needs. Like I said, I keep track of my expenses on a spreadsheet and like to enter them myself.

Some people like to sync all of their accounts but I found that to be dangerous because everything becomes automatic and I might not pay attention to my spending.

Track Your Spending

Whatever way you choose to track your spending is fine with me, as long as you do it.

You might think that tracking your spending is silly because you can do it all in your head, but I would advise you give it a try for a month or two. If after two months you find yourself saving more money than before, then tracking your spending helped you. If it doesn’t, then at least you tried.

How do you track your spending? How big is your purse?

We use Mint for expense tracking. It works fine, and over the years I’ve built a ton of rules to categorize common expenses correctly so it’s mostly hands off. We don’t usually buy anything with cash, so all of our spending naturally flows into Mint.

My purse size? Well… it’s either really small (my wallet), or really huge (my backpack). Going to and from work I have a pretty large backpack to keep my laptop, lunch, rain gear, bike lock, bike maintenance kit, etc… I guess it could be considered my purse. 🙂

Mint is pretty good. I don’t use it because I weird and like to enter the numbers in my spreadsheet myself.

The backpack makes total sense if you’re on a bicycle and have to carry everything that a car could carry.

I like using a spreadsheet as well – I couldn’t get into Mint. You bring up a good point that it’s not for everyone, either, because they might not be inclined to check it or be an active participant in it. I’m always on the “track your spending” bandwagon, though. You can learn a lot from it!

My purse is pretty big. I can fit my iPad and a notepad in there! I’m not the biggest fan of their size, but I ordered two online and I didn’t realize just how big they were.

Yes, Mint is a great program but it’s really not for everybody. I usually tell people to give it a try, but also to check out other ways and see what works best for them.

I’m not opposed to big purses, I just feel like sometimes people go way too big. Ya know.

I use Mint for detailed tracking on spending and Excel to keep my budget and track net worth. I monitor our accounts very frequently (mainly to check for fraudulent transactions since we travel more than most). Mint really helps me to centralize the data so I can easily review it.

I tried Mint and I see why people love it so much. That’s why I recommend it to some people, but there are others that need to be more hands on with their finances.

We use a shared google doc spreadsheet right now, but I’ve used paper and more sophisticated methods in the past. Tracking expenses is such an important step of managing your money!

Hey whatever you use is fine by me – as long as you track your expenses. There are people that don’t need to track their expenses because they are pretty good at handling money, but we’re not all like that.

I use an excel spreadsheet to plug in the main numbers, but I have never had a month where I wrote down every single line item, like every single grocery item, fun money spending, etc. I really think at some point that might be in order, and if I did I would probably use just pen and paper.

Whoa, take it easy Tonya. I don’t write down every single grocery item, haha. Just the total amount of the food shopping trip. I’m crazy, but not that crazy.

I have been using paper and pen becuase I feel more involved in the process I have heard of Mint but I thought I had to pay for it

I use MINT but I also have a spreadsheet. The spreadsheet came first, plus I have a cashflow statement in the file. That’s why I keep it up, even though I also use MINT for tracking against budget.

I’ve noticed a lot of people do both as well.

I used to use Mint, but mainly just make a Google spread sheet now. Tracking spending is really the first step to getting out of debt of building wealth. Everyone thinks they spend wisely until they really look at what they are buying.

Tracking spending is really the key. My finances took a good turn when I started tracking my expenses. I don’t think I’ll ever not track them again.

We track our spending with our bank and credit card statements and create a budget with pen and paper. We’re old school! =)

hey whatever works for you! the good thing is that you’re doing it.

I think tracking is an awesome way to get your finances in order. I have a client who loved using the track your spending app on his phone. I think it was free and the month that he committed to tracking his money was his best month to date. We actually recently met and he said he felt as though he was slipping again and we reinstated the daily tracking as his cure.

Good for him! I hope he keeps doing it and develop this great habit.

Tracking your spending is my number one piece of advice to people trying to take charge of their finances. So simple but surprisingly life altering.

I know, I couldn’t believe that this was all it took to grab a hold of my finances. Once you know where you’re money is going, you could guide it to the right places.

Thank you for this article! I have the hardest time finding a good way to keep track of everything. I’ll be trying some of these tips for sure!!

You should definitely give it a try, Stephanie. You will see how much clearer your finances look after you track your expenses.

I’ve done a little of everything, but we’re at the point where our income is so far ahead of expenses that we don’t track everything anymore. We know how much goes toward investments each month because our expenses are set and rarely change. It took a lot of time and effort to get to this point and you will never get there if your spending is out of control and you don’t really understand the difference between your income and spending.

That’s great that you don’t have to keep track anymore. I’m not there yet, but soon.

I use a spreadsheet in Excel. It works really well for me, but it’s too messy to publish online, so I haven’t shared it yet. I think people really just need to find what works for them.

Yes, mine is a little messy as well. If I share it, people would be like, “What’s happening there?”

We use a spreadsheet in Excel and track the different categories. I don’t feel comfortable to use online spend tracking applications like Mint and provide all my banking information to the tool.

Yes, I’m a little hesitant to give them all my bank information as well. That’s why I use my spreadsheet.

We use a gool ol’ ledger to write our monthly expenses. We set an amount for our expendables but should probably start writing down what those expendables are. I am definitely a pen and paper kind of gal!

That works too! I started with a notebook, but found that the spreadsheet was much easier to access. I keep mine on Google Drive and can access it from anywhere.

We use pen and paper, haha! We use spreadsheets for all of our business expenses, but for bills and day-to-day budgeting – a pen and paper! I do want to look into Mint, though. I’ve heard great things and would love to give that a try!!

Mint is pretty cool. A lot of people like it. I just love my spreadsheet, ya know.

Tracking expenses—ugh, the bane of my financial existence.

We don’t use software because we are on a primarily cash budget, but I still hate sitting down each week and doing it. I always dread it, but in the end, it really does not take that long.

It only really takes long the first month or two. After that is a breeze… at least for me.

I use Mint to keep track of all of our transactions and then just export it into Excel at the end of the month (sometimes more). I keep budgets in Excel as well as Net Worth stuff, just because Excel and I are good friends and Mint is more of a casual acquaintance to me. My purse is pretty big, but empty. I like being able to walk to the library and throw a few books in there. It also holds 3/4 of a squirming dachshund.

If your purse is also used as a pet carrier then that’s fine with me!

I hear you about Excel. Excel and I are tight as well.

Great article! Tracking your spending is the foundation of a good budget, which is funny, because I use Goodbudget to track everything. When I first started, I just used it for tracking purposes until I could start setting my budgets. Now I have my entire budget in it and it’s so easy to use. (I use the app and the website)

I use YNAB (You Need A Budget) software to track my expenses. As far as the big purses, I have no idea. I like the look of big purses but I could never find enough “stuff” that I thought I needed to carry with me…until I had kids. Now I have my everyday purse which is small then I have the “Mom purse” aka the big purse which I only brig out when I need to stuff it full of things to keep my kids occupied like the iPad, snacks, drinks, an extra diaper with wipes and a pair of extra boy undies and a zipper bag.

Great post….as usual! :o)

Thanks for the good budget app tip. That’s something I can use in our accountability group sessions. I’m going to check that out immediately.