All debt is bad… or is it?

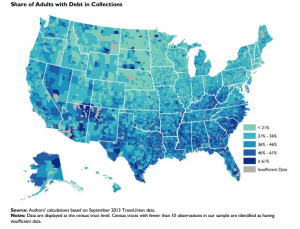

Debt is such an integral part of our daily lives that most people think it is the only way to live. I can’t even count the amount of times I’ve heard people say, “I will always have debt.” This makes me sad because it doesn’t have to be so. Debt is not necessary.

That being said, I’m not opposed to certain type of debt. I would even go as far as saying that some debt is actually good debt. Okay I take that back, no debt is good debt, but you could argue that some types of debt are not “as bad” as others.

Good Debt – a.k.a. A little better debt.

Good debt is debt that helps you build assets, helps you make more money, and/or increases your net worth. Some examples of good debt include:

Home Loan – Okay, I personally don’t think that buying a house is a must, but I also don’t think that getting a loan to buy one is a bad idea either… as long as you can afford it. The value of a house usually increases over time so a house is more of an investment than an expense.

You have to understand though, that the value of a house doesn’t always increase and there’s definitely the potential of losing money, so I wouldn’t advice you to purchase a house unless you are ready. Meaning, you have a 20% down payment and an emergency fund of 6 months to 1 year worth of expenses in case something goes wrong.