The other day I was on Netflix scrolling though all the options and trying to figure out what to watch. I like watching series on Netflix because I know exactly what I’m going to watch and I don’t have to waste time scrolling through the options. But I had just finished watching the last season of Peaky Blinders – which is awesome btw – and I like to give movies and/or documentaries a chance before jumping into another series binge.

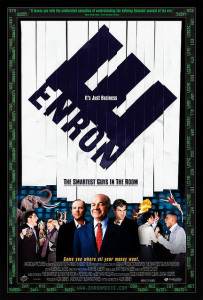

This quest lead me to a documentary about Enron titled, “Enron: The Smartest Guys in The Room.” I have to admit that even though I had heard about Enron – I knew it was a large company that went bankrupt in a matter of days because of some type of corruption – I didn’t know what really happened.

I should have known this because it was such a big scandal, but I just wasn’t interested in anything related to finances, money, or investing at that time. Now I blog about personal finances, money, and investing so I decided to be more informed about these things.

I recommend everybody to watch this documentary or read more about Enron’s collapse because it taught me a few things.

What a Bunch of Crooks

Enron was one of the biggest companies in the U.S. with claimed revenues of $111 billion in 2000. Enron was one of the world’s major electricity, natural gas, communications, and pulp and paper companies. Enron was so big and powerful that its collapse shook Wall Street to its core.

Enron executives, in particular its CEO Jeffrey Skilling and its CFO Andrew Fastow, were doing a lot of unethical things. Skilling and Fastow were using accounting loopholes and very poor financial reporting to hide billions of dollars of debt from different deals and projects. They also exploited the deregulated energy market in order to make billions of dollars.

One of the ways that Skilling and his executive staff were able to hide billions of dollars of debt was by the use of mark-to-market accounting. With this type of accounting, Enron used to build up an asset, like an energy plant, and claim the projected profits on its books, even though it hadn’t made any money from the plant yet.

If the revenue from the plant was lower than the projected amount, Enron would transfer the assets to a corporation that was “off-the-books” and the losses would go unreported. This, in turn, made Enron appear to be in much better shape than it really was.

There were other deceitful schemes that Enron executives did and you should watch the documentary or read up about it for a much better explanation than I can give you.

Diversify, Diversify, Diversify

Why would you care that a company collapsed in 2001? Well, if you are reading this site it is because you are probably trying to take control of your finances, and this means that you are looking into, or are already investing in the stock market. And what happened with Enron is a perfect example of why you should diversify your investments.

Enron was one of the biggest companies in the United States and their stock market value was rising every year. Based on the returns that people were getting, it wasn’t a bad idea to invest in Enron.

But no matter how big or how great a company is – or appears to be – it is never a good idea to have more than 10% of your portfolio invested in a single company because you just never know when that company is going to fail.

This is especially true if that company is your employer.

A lot of people think that they should invest most, or all of their retirement contributions into the company where they work, but that is not a smart move because – as a lot of Enron employees found out – if your company goes down, not only do you lose your job but you also lose your retirement money.

Unfortunately that was the case for many Enron employees, who had 100% of their 401k invested in Enron stock. Those employees not only lost their job, but also all of their retirement at the same time. Ouch!

Investing in the stock market is always risky, but you can lower that risk by diversifying. There is no perfect formula for diversification, but just know that diversifying is always (almost always?) better than not diversifying.

The best way to diversify – in my opinion – is by investing in mutual funds, specifically low-cost index mutual funds. Mutual funds are instant diversification since you are investing in dozens if not hundreds of companies at the same time.

Don’t let the next Enron bite you in the a$$ and diversify!

Thanks for the movie recommendation! I’ll check it out. I think people should diversify in all aspects of life — especially related to income and investments! Have a great holiday this week, Aldo!

Like you, I was that interested in finance when the whole Enron story exploded – but I am now! I will definitely check out the documentary. You make such a good point about diversifying – especially if you work for the company. You just never know.

I just watched the documentary, I have to say big lessons leaned! Thanks for sharing the synapses 🙂

Erik