“Compound interest is the greatest mathematical discovery of all time” – Albert Einstein.

He probably didn’t say that but I’m going to say it because to me, it was. And this is how I plan to have a Million Dollars in savings one day. Now, if you are looking for a way to get rich quick then this site is not for you. Our plan is to slowly build our savings and not touch it to let compounding do its magic. All we need is discipline and time… lots of time. So be patient. Just start saving early, often, and for a long time.

This is the one of the ways we normal working people become rich.

I decided to write about compound interest first because once we understand its power then all of our saving strategies will make more sense.

Compound Interest

Compound Interest just means that you earn interest on the interest you earn on your money. Gwat? It is how you make your money earn you more money. You receive interest on your original investment and on any interest that accumulate, thus helping your investment grow faster and faster every year. For example, you deposit $1,000 into an interest yielding account that earns interest at a rate of 6 percent per year. At the end of the year, you earn $60 in interest and now you have $1,060. If you don’t touch the interest and keep it invested along with your original investment then at the end of Year two you earn $63.60 in interest for a total of $1,123.60. If you do the same in Year three then you earn $67.42 at the end of the year for a total of $1,191.02. Your returns grow faster and faster because the interest gets compounded every year.

| Year | Principal + Interest | Interest Earned |

|---|---|---|

| 1 | $1000.00 | $60.00 |

| 2 | $1060.00 | $63.60 |

| 3 | $1123.60 | $67.42 |

| Total | $1191.02 |

But if you keep your savings under the mattress or in a savings account that doesn’t pay interest then you are not taking advantage of what I call free money. You have to invest your money in the right places and the best place to start is your retirement account.

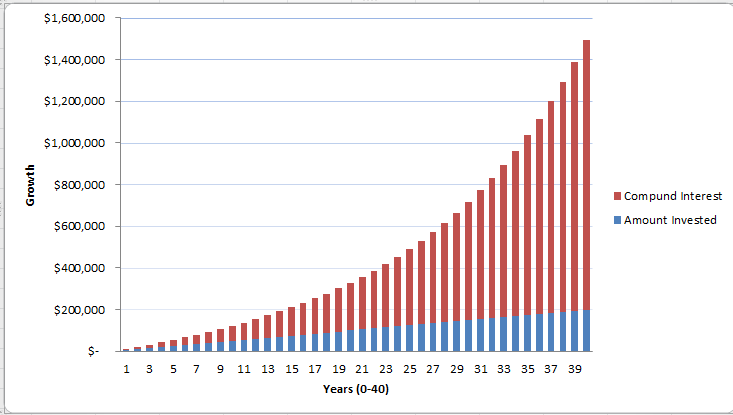

Let’s say you are 25 years old and make $50,000 a year. You decide to save 10% towards retirement, or $5,000 a year. If you keep it in a savings account that pays zero interest then you would have $200,000 by age 65. ($5,000 x 40 years = $200,000) But if you invest it in a no-load mutual fund that earns an average of 6% per year then your $5,000/year would grow to $773,809.83! You invest $200,000 of your own money and you earn $573,809.83 in interest. This, my friends, is the power of compounding. And this is being conservative and assuming only a 6% return, but the average return of index mutual funds has been over 8% when invested over 10 years. With an 8% return your $5,000/year investment would grow to, you might want to sit down for this, $1,295,282.59. That is One Million, Two Hundred and Ninety Five Thousand Dollars. But it doesn’t happen overnight. As you can see in the chart below, it needs time to grow.

The beauty of the example above is that we are assuming that you will never get a raise, so you know it has the potential of growing even more. The trick is to start early because the longer you invest the greater the growth.

| Year | Amount Invested | Compound Interest |

|---|---|---|

| 10 | $50,000.00 | $72,432.81 |

| 20 | $100,000.00 | $228,809.82 |

| 30 | $150,000.00 | $566,416.06 |

| 40 | $200,000.00 | $1,295,282.59 |

You don’t have to start saving 10-15% of your income right away, any amount helps. You can start with 5% or any amount that you can while you pay your consumer debt and build your emergency fund. And when you get a raise, use some of it to fund your retirement until you are saving at least 15%.

Play around with the calculator below to see how much your annual contributions will grow if you stick with a plan. (The calculator is also located on the side of the page.)

Please understand that this is only for retirement or any long term investments. Your emergency fund should not be invested in mutual funds because the market is very volatile from year to year. Your emergency fund should be in cash and it should be in some sort of savings account that pays you interest. Right now savings account interest rates are terrible. The best I have seen is 0.95% annual percent yield (APY), which might not be much but 0.95% APY is better than NO% every time. You can check bankrate.com for current Savings Account rates. Hopefully you won’t need to use your emergency fund at all and let compound interest work in your savings account as well. The reason we don’t want our emergency fund invested in the stock market is because we don’t want to find ourselves in an emergency when the market is down. We want our emergency fund as safe as possible. The volatility of the market is not a problem when investing for 20 or 30 years though. When investing long term and the market goes down, don’t panic. You have to be patient and have nerves of steel and trust that the market is going to rise again, which it always has.

You should also check whether your current bank is charging you fees or making you money. I switched my checking account to Santander because they have an offer where they give me $20 dollars a month for having a direct deposit totaling $1,500 a month and paying two bills online. My previous bank, I’m looking at you Bank of America, was not giving me anything. What’s $20 a month going to do? $20 a month is $240 a year and if we invest it in our retirement account assuming an 8% return, then we would make $27,000 in 30 years.

If we start making long term investments and let interest compound, we will slowly build enough wealth not only to create a better future for our children but also to be better equipped to help others in need. So instead of giving away our money to banks and credit card companies, let’s keep it and use it for the greater good; whatever that might mean to you.

Hi Aldo

Thanks for explaining compound interest. I’ve been trying to explain how compound interest works to my hubby so have just emailed him your article to read. Thanks! 🙂

Hayley,

Thanks for reading and I’m glad you liked the post. I really didn’t know anything about compound interest before but now I know that it’s one of the most important tools for making your money grow.

I love your blog by the way. I sent you an email about an easy suggestion, hope it helps.

Your suggestion certainly did help, thanks so much! 🙂