I don’t know about you, but I can’t wait until I don’t have to work anymore. I get to wake up every day and do whatever I want. No more rushing to get to work on time. No more going to sleep early because I have work the next day. No more only taking one to two-week vacations because I have to go back to work. No more having to work because I need money. Oh wait, money. I will still need money to pay for my Senior Citizen Water Aerobics class and for my month-long vacations. Where am I going to get that money?

This is when retirement planning pays off.

We already know about compound interest, and our retirement accounts are the best places to take advantage of compounding. I didn’t start investing as much as I should when I started working because I didn’t understand how retirement plans worked, and I missed out on eight years of compounding. Start as soon as possible so you can get the most out of it.

There are different types of retirement accounts but we will only cover a few that everybody should know about.

Before you start asking yourself if you need a retirement plan, here’s an infographic to help you answer that question.

Share this Image On Your Site

Retirement Accounts

1. Retirement plan offered by your employer

The name of your plan is called depends on where you work. 401(k) plans are offered by corporations. If you work for a nonprofit, such as a hospital or a school, then you probably have a 403(b) plan. 457 plans are offered to government employees. There is also what is called SIMPLE IRA or Savings Incentive match for Empoyees IRA, which are retirement plans that small companies can offer. These plans all work in a similar way so to keep things simple I will only refer to them as 401(k).

A 401(k) is probably the most common type of retirement account because it is a workplace retirement account. Most employers enroll you automatically in their 401(k) plan, but with some you have to enroll yourself. You designate how much of your paycheck goes into your retirement account and that amount is automatically deducted from your paycheck. The beauty of 401(k) plans is that it allows you to contribute a portion of your pre-tax salary lowering the amount of income taxes that you pay. For example, if you earn $50,000 a year and contribute $10,000 to your 401(k), you are only taxed on an income of $40,000. Also, your investment gains grow tax deferred until retirement. You pay regular federal, state and local income taxes on the funds you withdraw at retirement. Keep in mind that if you withdraw funds before retirement age (typically 59 ½) you will pay a 10 percent penalty and could be subject to income taxes. Some employers offer 401(k) loans without any penalties but if you leave the job for any reason (even getting fired), the entire loan must be paid in full or it will be considered an early withdrawal and taxed as above.

Another reason why 401(k) plans are so good is that many employers will match part of your contributions. Different employers have different ways of matching contributions. My employer, for example matches 75% of my contributions if I contribute up to 6% of my salary. That is, if I contribute 6% the company contributes 4.5% for a combined contribution of 10.5% of my salary. If you get the employer match, make sure you take advantage of it because you don’t want to leave money on the table, so to speak.

For 2014, 401(k)s have an annual contribution limit of $17,500 or $23,000 if age 50 or older (the limit gets adjusted every few years for inflation). But were are not going to concentrate on reaching this limit just yet. You should just contribute enough to get the maximum company match for now.

Before you contribute more than the amount needed to get the maximum company match or if the company doesn’t match, you should first consider contributing to a Roth IRA. We can come back and contribute more to the 401(k) later.

2. Roth IRA

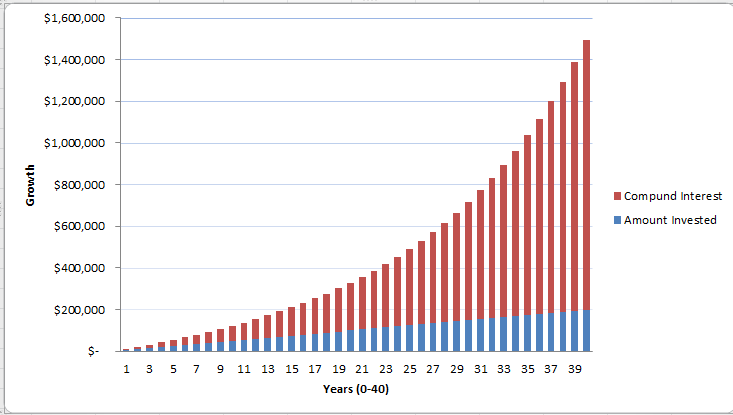

A Roth Individual Retirement Account (Roth IRA) is one of the best retirement accounts currently available. Unlike the 401(k) where contributions are taken from your paycheck before taxes, Roth IRA contributions are made by you with the money you get after taxes. Since you already paid taxes, all the growth that is generated is tax free. That means you don’t owe taxes on that money ever. With the 401(k) your contributions and growth are tax deferred, which means you don’t pay taxes now, but you will have to pay taxes on the full amount you withdraw when you retire. Let’s use the same example and chart we used in the compound interest post: with the Roth IRA you only pay taxes on the $200,000 invested and not on the growth; with the 401(k) you owe taxes on the entire $1,295,282.59. That’s a big difference.

Another great benefit of the Roth is that you can withdraw any of your contributions at any time without penalty or taxes. With a 401(k) you have to pay a 10% penalty and pay income tax on the money you withdraw before age 59 ½. Let’s say that we invest $5,000 into our Roth this year and $5,000 the next year, then we have invested a total of $10,000. Let’s also say that our investments have grown in value and our account is now worth $11,000. You could withdraw the $10,000 you invested at any time, but will have to leave $1,000 in the account until you are 59 ½ to avoid penalties. Try not to use your Roth IRA as an emergency fund though; the ideal situation would be to have both.

Roth IRAs are great but are only available to those who qualify and there is a contribution limit. See table below.

2014 Income and Contribution Limits for Roth IRA

| Filing Status | Income Limit* | Contibution Limit |

|---|---|---|

| Single | $114,000 or less | $5,500 ($6,500 age 50 and over) |

| $114,001 to $129,000 | Begin to phase out | |

| Greater than $120,000 | Ineligible | |

| Married filing jointly | $181,000 or less | $5,500 ($6,500 age 50 and over)** |

| $181,001 to $191,000 | Begin to phase out | |

| Greater than $191,000 | Ineligible | |

| Married filing separately*** | 0 | $5,500 ($6,500 age 50 and over) |

| $1 to $9,999 | Begin to phase out | |

| Greater than $10,000 | Ineligible |

**Each person. Total for a couple could be $11,000

***Married filing separately can use the limits for single people if they have not lived with their spouse in the past year.

If you qualify for a Roth IRA and are not getting a company match through your 401(k), then the Roth IRA should be your best friend. If your employer gives you a match then get it before investing into a Roth because the company match is free money. So if our plan is to save 15% of our salary towards retirement then we should contribute as much as necessary on our 401(k) to get the company match and then contribute to the Roth IRA. If after reaching the maximum contribution on your Roth you still haven’t met the 15%, then go back and contribute the rest to your 401(k). If you don’t get a company match, then start with the Roth IRA and then invest the rest on the 401(k). Remember that 15% should be our goal, but this amount is not always feasible. Just start with whatever you can and increase it little by little.

The 401(k) and Roth IRA are the best options for retirement accounts but not everybody qualifies and that’s why there are other options.

3. Traditional IRA

A traditional IRA is an option if you don’t have a workplace retirement plan, such as 401(k), and/or are not qualified to contribute to a Roth IRA. Traditional IRAs work in a similar fashion than 401(k) in which your contributions are tax deferred. Taxes are due when you withdraw your money at retirement. But unlike the 401(k), you might not be able to deduct your contributions from your annual income. If you are eligible for a 401(k) at work you cannot deduct IRA contributions from your annual income even if you don’t participate in the 401(k) at work.

The contribution limits for the traditional IRA are the same as with the Roth IRA but there is no income limit to qualify. Your income may disqualify you from contributing in a Roth IRA but there is a loophole that you can take advantage of. You can contribute to a traditional IRA and then convert it into a Roth IRA. You would have to pay taxes when you convert but the money grows tax free from there on out.

4. SEP IRA

A SEP IRA or Simplified Employee Pension IRA is available to self-employed individuals. A SEP IRA allows an employer to make retirement plan contributions to its employees, similar to 401(k) plans. It also allows employers to create a SEP IRA for themselves even if they don’t have any employees working for them. The contribution limit for SEP IRA is much higher than that of a 401(k). You can contribute as much as 25% of your net earnings or up to $52,000 for 2014 (limit gets adjusted for inflation).

As you can see, there are different options but chances are you will only be eligible for one or two of these plans. But whatever your placement might be, make sure you have a retirement plan in place. It is by far the best and cheapest way to accumulate enough wealth to have a comfortable retirement. If you don’t have a retirement plan, make sure you look into getting one as soon as possible. You want to give compounding as much time as possible to work its magic. And if you start early, contribute often, and as much as you can, you might find that you have accumulated enough to be able to retire early.

I don’t want to have to work until I’m 70 years old. If I continue with my plan, it looks like I’ll be able to retire at 65 and be comfortable, but my main goal is to slowly lower the age I’ll be able to retire. One less year that I have to work is one more year that I get to enjoy doing whatever I want. Those old ladies are going to love doing water exercises with me.

Chances are that I’ll still be working after 65 but only because I want to and not because I have to.

So to recap:

- If you have a company match on your 401(k) make sure you contribute enough to get the maximum you can get, then try to max out your Roth IRA. If you still have more to contribute then go back to your 401(k).

- If you don’t have a company match then start with the Roth IRA and then go to your 401(k).

Also know that a retirement account it’s just that, an account. You park your money there but if you want it to grow you need to have your contributions invested in the right places. I will cover the different ways you can invest within your retirement accounts on the next post.

As you already know, I’m not an expert, a financial advisor nor a finance guru. I’m just a regular guy that decided to do some reading about the subject because I couldn’t take it anymore. I will provide you with all the information that I have gathered as accurately as possible but you should also do your own research and get professional help if you need it. You will find out that you can make most decisions yourself but there are occasions where professional help is necessary.

If you are not sure on what to do, ask for help.

Great infographic! Yep, retirement planning is a must. I don’t have access to a Roth IRA what with being in the UK and I also don’t have an employer matched pension as I’m self employed. I do have a couple of properties which are being rented out and although they are a pain in the neck right now with problems with tenants and general renting costs, I’m sure this decision will pay off later in life. I also have a Cash Isa, which is a tax free savings account. Not much in it yet, but my no. 1 goal at the minute is to pay off debt.

The retirement accounts mentioned here only apply to people in the US, but the main point of saving for retirement applies to everyone. But you are right, paying off debt should be priority number one because the interest you pay in credit cards is usually higher than any returns you might get from a retirement account.

My goal is to be self employed like you some day and also get into real estate. Maybe in a few years.

This is great. Out of curiosity, are you planning on writing about savings benchmarks? That was the one big question I keep thinking about over and over – how do I know if I’m on track with my savings?

I keep running into Fidelity’s age-based guide (*) but I would be interested in anything else you find.

(*) http://www.fidelity.com/inside-fidelity/employer-services/age-based-savings-guidelines

Thanks for your question AthenaC. I do plan on writing about savings benchmarks and the fidelity age-based savings guidelines are going to be one of my examples. Thanks for sharing it.

I also kept asking myself if I was on the right track until I found the fidelity guidelines. Situations may vary for individuals but their guidelines are definitely a good place to start.