How to Avoid Debt for Christmas

Ahh Christmas is almost here. Christmas season is the best time of the year for many, but it could also be one of the most stressful times for people who are in debt and can’t afford to buy gifts.

There is just so much pressure put on us to buy everybody and their mother a little something something for Christmas. If you don’t, then you are just like Ebenezer Scrooge.

The pressure comes from everywhere. There are countless Christmas commercials telling you what you should buy, there’s Christmas music everywhere (doesn’t tell you to buy stuff, but it reminds you two months in advance that it is Christmas season and that you should start getting ready), and there are also those who keep asking, “What are you getting [INSERT NAME] for Christmas?” It is not even November yet!

Don’t get me wrong. I love Christmas. It is a time to get together with your family and loved ones. Everybody seems to be happy – maybe tired of the Christmas songs, but happy – some of us gets a little break from work, and we get gifts.

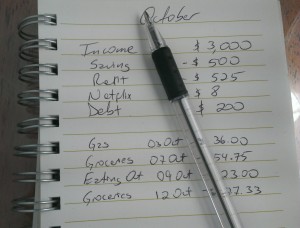

Yes, I like gifts too. The problem I have is when people get into debt just to buy somebody else a gift.