When I started my first job out of college, they told me I was automatically enrolled in the company’s 401(k) plan. I just had to decide what percentage of my salary I wanted to contribute and where I wanted my contributions to be invested. I then received a package from the company handling my retirement plan. There were pie charts and graphs and numbers that I didn’t understand explaining the different options I had to invest my money. I looked at all that information and started to panic a little bit. Where do I invest my money? I don’t want to invest in the stock market. I’ll lose all my money. The package also explained that if I didn’t choose anything then my funds will be placed in what looked like a savings account. So I chose the default because I didn’t know what to do.

I now know that picking the right fund is really not that difficult when you know what to look for. Here I am going to share with you what I have learned so we can have a better understanding of the choices available to us and about how to diversify our funds to lower our risk. I will mostly touch on investing in our 401(k) but the information applies for investing outside of your retirement account as well.

Investment Options

The options that we have are usually limited by our plan. We typically have the stock of the company we work for and different mutual funds. The number and type of mutual funds offered varies depending on the company you work for, but companies typically offer 8-10 mutual funds, a few bond funds, and a bunch of life-cycle funds to choose from. Aaaaah! Which one do I chose? Before you start to panic like I did, let me first explain the difference between all the options.

Companies tend to want to grow and expand, but in order for them to grow, they need money. They can get this money from a loan or they can raise money by creating a specific number of shares and selling them to the public for a specific price; this is called going public. When you buy a share of stock of a company you then own a tiny part of the company. But don’t go knocking on the company’s door screaming “This is my house now. You do what I say!” because you are probably going to get arrested. As a shareholder, we generally have no say in what the company does.

When the company does well, the value of the shares rises and we make money; if the company does badly, then the value goes down and we lose money. If you want to buy or sell stocks you have to go through a stock exchange. The biggest one is the New York Stock Exchange but there are other stock exchanges as well.

As a rule, we never want to have all of our money invested in just one company. If we have 100% of our money in one company and their share value goes down 10%, we just lost 10% of our money. But if we invest equally in 10 different companies (10% per company) and one of them goes down 10% then we only lose 1% of our money. What we want to do is invest in many different companies that work in different fields; we want to diversify. This is where mutual funds come in.

A mutual fund is just a fund that owns tens or even hundreds of individual stocks. By buying mutual funds we get instant diversification, which means our risk of losing money decreases by a lot. Nobody knows which company is going to do well and which company is going to do badly; not you, not me, not even the so called experts. If they knew then they’d all be Billionaires. Our best bet is to diversify as much as possible and hope for the best.

There are hundreds of mutual funds. There are mutual funds that invest in tech-companies, some that invest in health care companies, some that invest in big companies, some that invest in small companies, etc. The point is that there are mutual funds for any type of investor. But, like I mentioned before, we only have a few choices within our 401(k).

To keep risk low with a good return, most of our portfolio should be invested in mutual funds.

Bond funds are just mutual funds for bonds. Like I mentioned, companies need money to expand and one way to raise money is by selling shares. A second way they can do this, and this is one of the ways governments raise money for infrastructure, social programs, etc., is by issuing bonds. Bonds are just loans you give companies and governments and in turn they pay you interest. There are different types of loans with different maturities (length of loan), but for the most part they pay interest at a rate that was determined when you buy the bond. That interest rate stays the same until the end of the loan known as the maturity date. You can read more about the different types of bonds here.

Since bonds are a loan they are also known as fixed income because you know exactly how much money you are getting each year. For example, if you buy $1,000 worth of bonds at a 4% interest rate, then you get $40 a year for the duration of the loan. For this reason bonds are less risky than stocks. Bonds don’t go through the rollercoaster of the stock market but they also don’t get the higher returns we get with stocks.

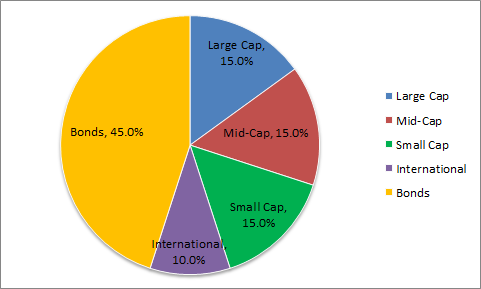

Stocks have historically outperformed bonds for periods of 10 years or more. This is why financial professionals recommend having most of our money in stocks if we are more than 10 years away from retirement. As we get closer to retirement, more of our money should be allocated to bonds. If you don’t want to be in control of how to allocate the amount of money going to stocks and bonds then you can opt for a life-cycle fund.

4. Life-cycle funds

Life-cycle funds are our one stop shop solutions if we don’t want to pay attention to our portfolio for a long time. Life-cycle funds or lifestyle funds are funds that hold the proper ratio (according to the fund’s manager) of stocks to bonds corresponding to our age. These funds have the desired retirment year in the name, so if our plan is to retire in 2045 then look for the fund that has 2045 in its title. The year is usually followed by Life-cycle, Lifestyle, or Retirement PF (portfolio).

These funds will automatically allocate our investments in different stocks, bonds, stocks from different countries, different industries, large companies, small companies and so on. Also the funds will readjust the ratio between stocks and bonds as we approach retirement age. If we have 30 years until retirement then our fund will hold mostly stocks, but as we get older it will automatically scale back on stocks and invest in less risky investments, such as bonds.

Opting for a life-cycle fund is perfectly fine if we don’t want to think about our investments ever again, but it is not the best option if we want more control of our finances. We can do a better job, potentially get better returns, and pay fewer fees if we pick our own funds.

What you do with your money is up to you but you might want to have most of it invested in index mutual funds.

How To Pick The Right Funds For Me

When we look into a particular fund they give us a lot of information: charts, performance, holdings, and fees. They also tell you if it belongs in Large Cap, Mid-Cap, Small Cap, or International. Sometimes they show a scorecard on how they rank based on different rating systems. All that information is good to know but it can be overwhelming for inexperienced investors; it sure was for me. In reality there are just a few things that we should know which will help us understand what to look for.

The charts are just graphs of how the funds compare with a particular benchmark, usually the S&P 500. The S&P 500 is a stock market index based on 500 large companies that have common stock listed on the New York Stock Exchange. The S&P 500 is also known as the index. So the charts is just to show us how they are doing when compared to the index. They sometimes list charts for 1-year, 3-year, 5-year, and 10-year performance. Keep in mind that the S&P 500 index is not the only benchmark that funds use.

The performance is just how good or bad they have done and it’s displayed as percent rate of return. These numbers are more important than charts because it displays their actual performance in a particular range of years. We’re going to keep an eye on the 10-year return and on the performance since inception if it’s greater than 10 years. We want to look for funds that have endured the test of time. We should stay clear of funds that only have been around a few years even if their returns look amazing because they might be on a roll now but history has shown that many funds under-perform the index when compared for more than 10 years. The S&P 500 index has had an average of about 7% return per year in any ten year period, so make sure the fund you pick has at least 7% return in 10 years.

The holdings are a list of the companies that the fund is investing in and the percentage of contributions in those companies. Some funds have hundreds of companies and those companies are chosen by the fund’s manager.

The fees are what we pay every year to have those funds managed. Mutual funds have fund managers who pick which companies belong in the funds and how much money to invest in those companies. They also decide when to buy shares of a company and when to sell the shares if the company is doing badly and affects our overall performance. For this work, they charge a fee. We must pay attention to the fees because they vary depending on the fund. The fees are known as “expense ratio” and are displayed as a percentage. If your fund has an expense ratio of 1% and you have $1,000 dollars in your account then you pay $10 a year. Our goal is to look for funds with the lowest expense ratio possible. As a rule, we want to pay less than 1% in fees, but should try to find funds with expense ratios under 0.20%. The less you pay in fees, the more money you get to keep.

Keep in mind that these fees are minimal when compared to the price of buying individual stocks. Even when you use discount brokers the price per trade is around $7.00 so if you want to invest in 10 different companies, you would have to pay $70 in transaction fees per trade. With mutual funds, you are investing in hundreds of companies and all you pay is the expense ratio every year.

So when searching for the right fund, look for the 10-year performance (preferably greater than 7%) and look for the expense ratio (as low as possible, 1% max).

Index funds are ideal because they meet both of these requirements.

Index funds only try to mimic the market. Most mutual fund managers look for ways to beat the market and most of them are unsuccessful. They might be able to beat the market one year or even five years straight but historically only a handful of managers have been able to accomplish this feat for longer than 10 years. The number is practically zero when compared for 20 years. Even though past performance is no guarantee of future returns, the market has had an average rate of return of at least 7% for over 100 years. Even with inflation averaging 3% per year, by investing in index funds we are averaging 4% greater than inflation. Also, since index funds are only trying to mimic the market, fund managers don’t have to do that much work, therefore the expense ratios for index funds is extremely low. Most are less than 0.20% and some are as low as 0.02%! By investing in index funds we are beating most managed mutual funds and paying less in fees. That’s a pretty good deal if you ask me.

Now, there are different index funds that pretty much track the same companies so having a Vanguard Large Cap index fund, a Fidelity Large Cap index fund, and a T.Rowe Price Large Cap index fund makes no sense because they all track the same companies. You are not diversifying. Mutual funds are already diversified, but to diversify even more, we should invest in index funds from different markets.

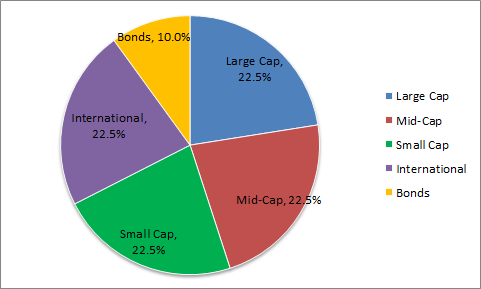

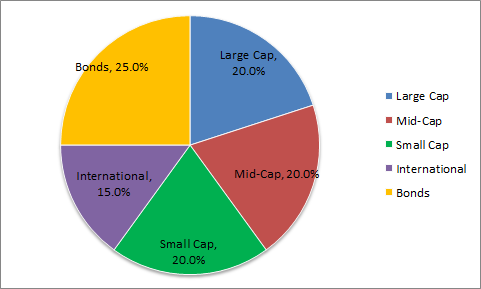

Financial professionals recommend splitting your investments into Large Cap, Mid-Cap, Small Cap, and International Index funds. Large Cap are just large companies, Mid-Cap are medium size companies, Small Cap are small companies, and International are non-U.S. companies. The way you split your investments is up to you but an even split between all four is a good start. In other words we should have four index funds and allocate 25% to Large Cap, 25% to Mid-Cap, 25% to Small Cap, and 25% to International. The reason we want to diversify between the market sizes is because some years large companies do well while other years small companies do well, and so on. We don’t want all of our eggs in one basket.

Asset allocation

Asset allocation is an investment strategy that aims to balance risk versus reward by dividing investment portfolios into different categories, according to the investor’s risk tolerance, goals, and time frame. It just means how to divide our money into stocks and bonds to get the best returns with the lowest risk that we can tolerate.

Most financial professionals agree that asset allocation is one of the most important factors in determining return for an investment portfolio.

There is no perfect formula for asset allocation but there are recommendations that we could follow. John “Jack” Bogel, founder of the Vanguard Group and one of the most respected figures in the field, recommends that we have our age in bonds. So if you are 30 years old your portfolio should be 70% stocks and 30% bonds. Others argue that since people are living longer nowadays, people should subtract their age from 110 or 120. So again if you are 30 years old your porfolio should be 90% stocks and 10% bonds if you are using 120 as your start.

Based on all recommendations, the portfolio of a 30 year old, 45 year old and 65 year old should looks something like this.

These are just recommendations. You apply them as you see fit. Just remember to rebalance every year. Rebalancing is a good strategy to help maintain your allocation ratios and improve performance. We all hear the phrase “sell high, buy low,” this is exactly what you are doing by rebalancing. Let’s say that your allocation is 50% Large Cap and 50% Mid-Cap, to keep things simple, and Large Cap companies do great this year as compared to Mid-Cap. Your allocation at the end of the year might look something like 60% Large Cap and 40% Mid-Cap. If you rebalance to get your allocations back to 50-50 then by selling 10% of the Large Cap you just sold high and by buying 10% Mid-Cap you just bought low. It is recommended that you rebalance your portfolio once a year or whenever your allocation deviates by 5%, whichever you prefer.

Now you understand why some people prefer the Life-cycle funds. You just pick your fund and it does all the rebalancing and allocation automatically for you, just sit back and let compounding work. This is great if you just want to set it and forget it. The only drawback is that you don’t have a choice on where your money is being invested and some people argue that this strategy is too conservative.

By picking your own funds and checking them once a year, you can potentially get even greater returns and it will help you understand your investments better. But remember to pick the right funds and forget about them until next year. It is not wise to check your investments every day because the market is very volatile and you might freak out when you see your investment go down 10%. Our best approach is to not even think about it and hope that it will pay off in the long run. If you don’t want to check every year, then do it every two years. Just don’t let too much time pass by. The more you know the better decisions you can make. Just remember that asset allocation is one of the most important decisions an investor can make, so get to it.