Spent: Looking for Change is a documentary that follows four financially under-served families who have been booted out of the traditional banking system due to different circumstances. If you ever thought “they got themselves into that situation,” think again. This can happen to anyone.

Keep reading to learn about each family’s situation and to watch the Spent documentary about payday loans, debt, and how our financial system is failing people.

Spent: Looking for Change

This weekend, I finally had the chance to watch Spent: Looking For Change and I have to say it was really eye opening.

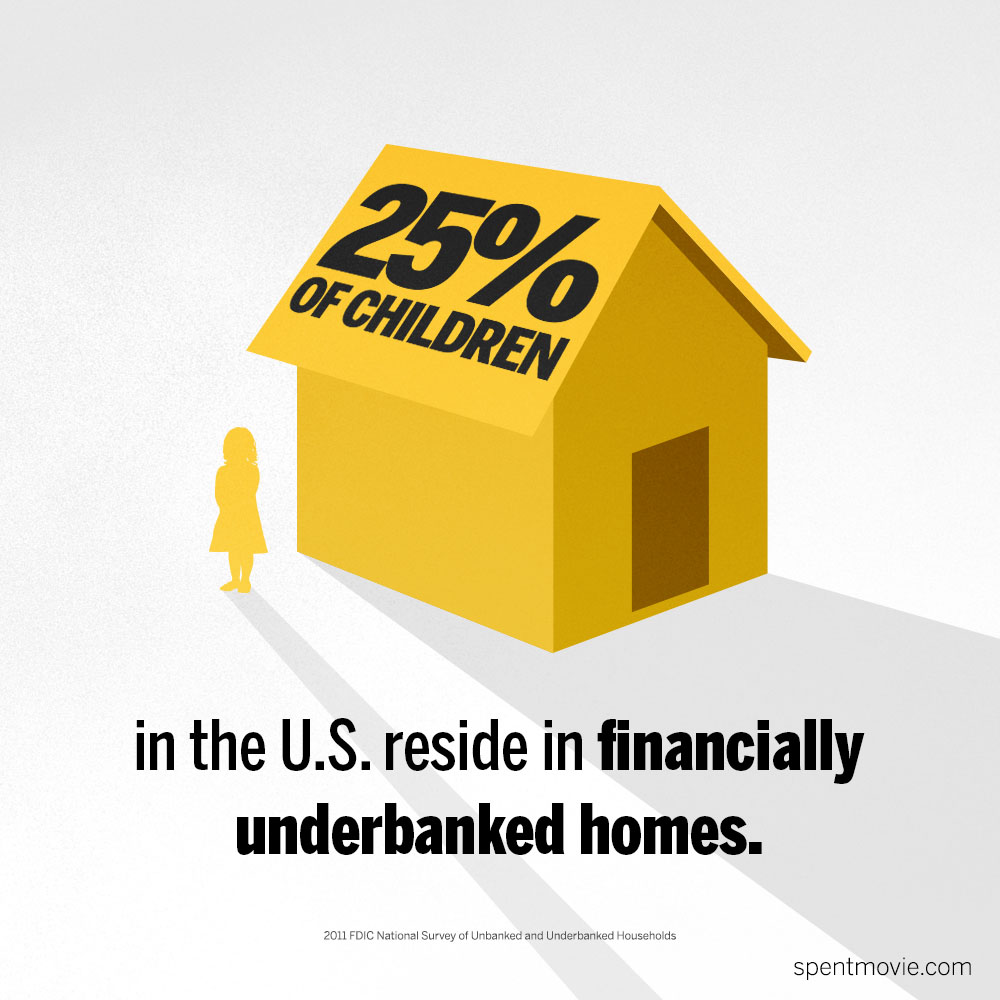

Spent is a documentary that follows four financially under-served families who have been booted out of the traditional banking system due to different circumstances. The four families represent almost 70 million Americans who don’t have access to banks and/or loans because of their credit or lack thereof.

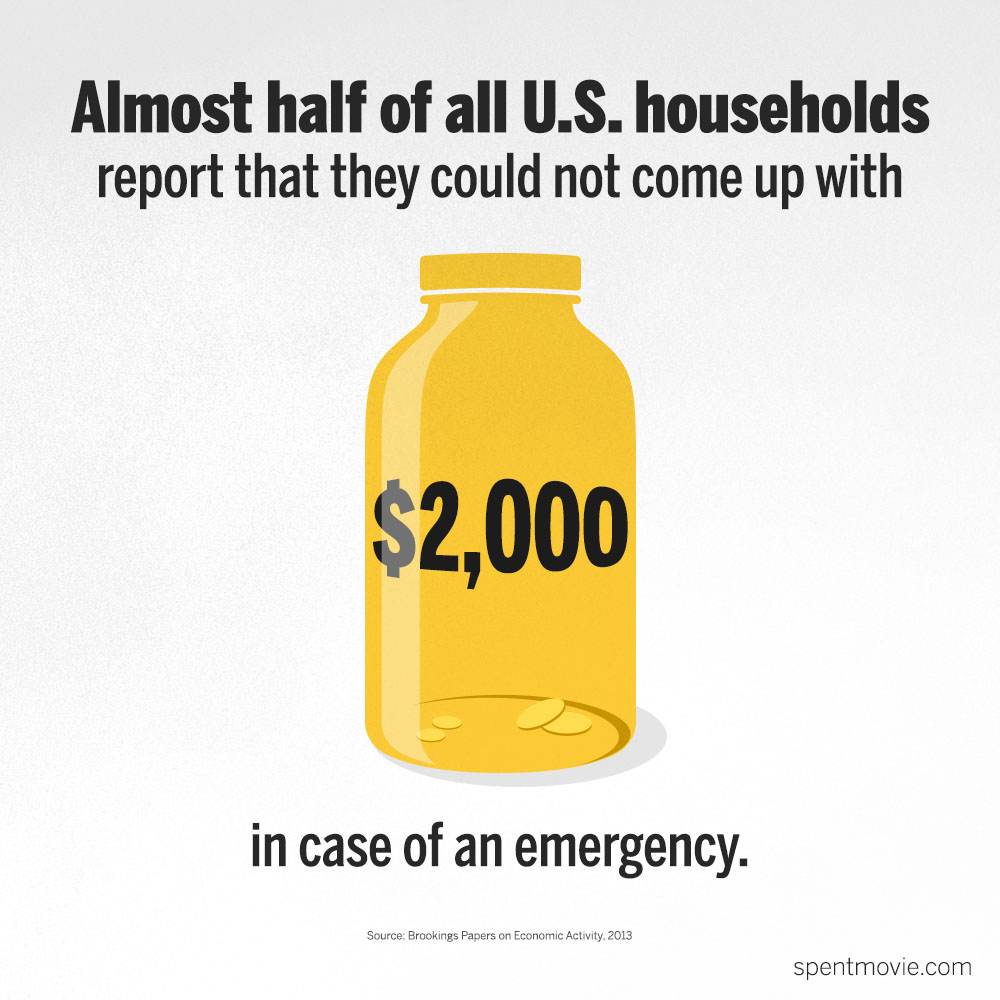

Since we use banks and credit cards on a daily basis, we take for granted how those services make our lives easier. Regardless of what we might think about our financial system, the fact remains that if we don’t have credit in the United States we are going to have a hard time getting a loan when we need one.

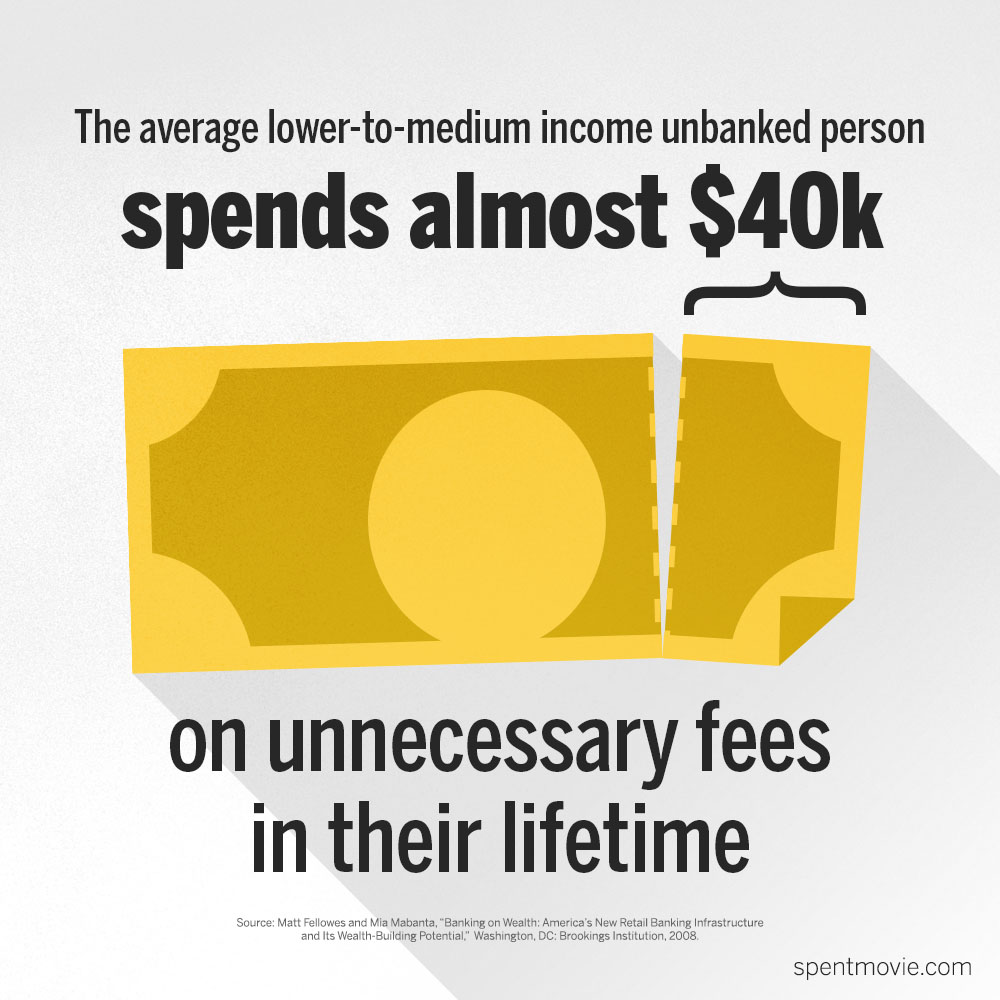

And it is not just about getting a loan. Due to the lack of credit or having bad credit, some people are not even able to open a bank account. They have to go to check cashing places in order to cash their paychecks – for a fee of course.

Related posts I recommend:

- Must-read personal finance books

- Ting review – how I cut my phone bill from $127 to $42 per month

Trapped in the cycle of payday loans

Spent also shows how easy it is for struggling families to get trapped in the cycle of payday loans. Payday loans are small loans that you are supposed to pay back when you receive your paycheck.

People who are struggling to make ends meet sometimes think that payday loans are the answer to their problem. Payday loans might help them at the moment, but they soon find out that those loans are more detrimental than helpful. But Spent is not just a payday loan documentary, it delves into how certain circumstances can change the financial lives of regular hard working people like you and me.

Spent: Looking for Change is available on YouTube and is only 40 minutes long. I highly recommend you watch it if you have the time. You can watch the whole movie below.

Watch the documentary:

The Four Families and Their Stories

Alex and Melissa

This is a couple who were trying to live their lives the right way. They didn’t believe in credit cards and didn’t want to get into debt so they decided to live a cash-only life. But by having a cash-only lifestyle, they were never able to establish a credit history.

Everything seemed to be working out for them until Alex was diagnosed with Multiple Sclerosis, making him unable to work. Melissa had a job, but it was barely enough to cover expenses.

The bills started pilling up and in order to avoid more penalties, they decided to get a payday loan of $450. They were supposed to pay the loan back with Melissa’s next paycheck, but since they were living paycheck to paycheck, they couldn’t pay the loan and instead paid the fee to extend the loan.

This went on every pay period and the $450 loan ended up costing them $1,700 in fees.

Unfortunately this is typical for people who get payday loans. Most people that get payday loans are unable to make ends meet. While getting a loan will help them pay some bills this pay cycle, when the next pay-check comes they still don’t have the money to pay the loan and they are forced to pay a fee.

Justin

Justin is a small business owner. He shoots videos for corporate clients and seems to be making a pretty good living. However, because of some mistakes he made in his youth, he is now unable to get approval for a mortgage.

Justin had a rough childhood and had to move out on his own when he was 16 years old. He then started accumulating credit card debt and decided not to pay it off, which ruined his credit.

Justin now has a pretty decent job and is good at managing his money, but his bad decisions still haunt him.

He is trying to buy a house with his girlfriend but is having a hard time finding a seller that is willing to negotiate with him. He has the money, proof of income, and all the paperwork required to purchase a house, but nobody wants to give him a mortgage because of the bad decisions he made years ago.

There are banks and mortgage companies that could give you a loan with bad credit or no credit if you prove that you can pay, but those are few and far between.

And on top of that, he also doesn’t have a regular bank account or credit cards. He needs to go to a check-cashing place to cash his check, for a fee.

Since a lot of places of business are moving away from cash, he needed to get a secure credit card, which he needs to fund with his cash, for a fee. And those cards charge a fee for every transaction. Fees on top of fees on top of fees.

Tiffany

Tiffany is another person who was doing everything right. She had a good job as a nurse, had been able to save over $100,000 in her 401k, and was able to send her daughter to private school to make sure she was getting a good education. But then tragedy struck.

Her mother was diagnosed with cancer and Tiffany decided to take a year off from work so she could take care of her mother. This is a very respectable decision which is best said in her own words:

That’s my number one patient. How can I take care of somebody else when I have my mom suffering at home?

She expected to live off her savings while taking care of her mom and then go back to work, but when the recession hit everything changed. Tiffany had been unable to find a full-time job and had depleted all her savings. Unable to pay the bills, she decided to get a Title Loan.

A Title loan is similar to a payday loan but instead of putting your next paycheck as collateral, you put the title of your car as collateral. As the story goes, she was unable to pay the loan and they took her car.

She also had to make the tough decision to take her daughter out of private school and away from her school friends.

Debbie

Debbie is a small business owner and I have the feeling she’s going to be just fine. She’s an entrepreneur who is just trying to make it.

Debbie makes leather bags and sells them to boutique stores. She seems to be working out of her bedroom and wants to expand her business, but is unable to get a business loan because of a large student loan and no credit history.

According to the film, she has never defaulted on her credit, but with no credit history and a large debt she looks like a liability to lenders.

She has a secured credit card to start building her credit history, but the card only has a $250 limit which she maxes out quickly buying the materials she needs to make the bags.

She has potential and all she needs is a little help.

I think with the exposure she’s getting from the film, she’ll be able to find an investor in no time.

But in the meantime, she’s struggling because as most people are living paycheck to paycheck, she’s living handbag to handbag with no emergency fund.

Final thoughts on the payday loan documentary

Spent: Looking for Change is a film that everybody should watch. It opened my eyes to the fact that nearly 70 million Americans don’t have access to the services we often take for granted.

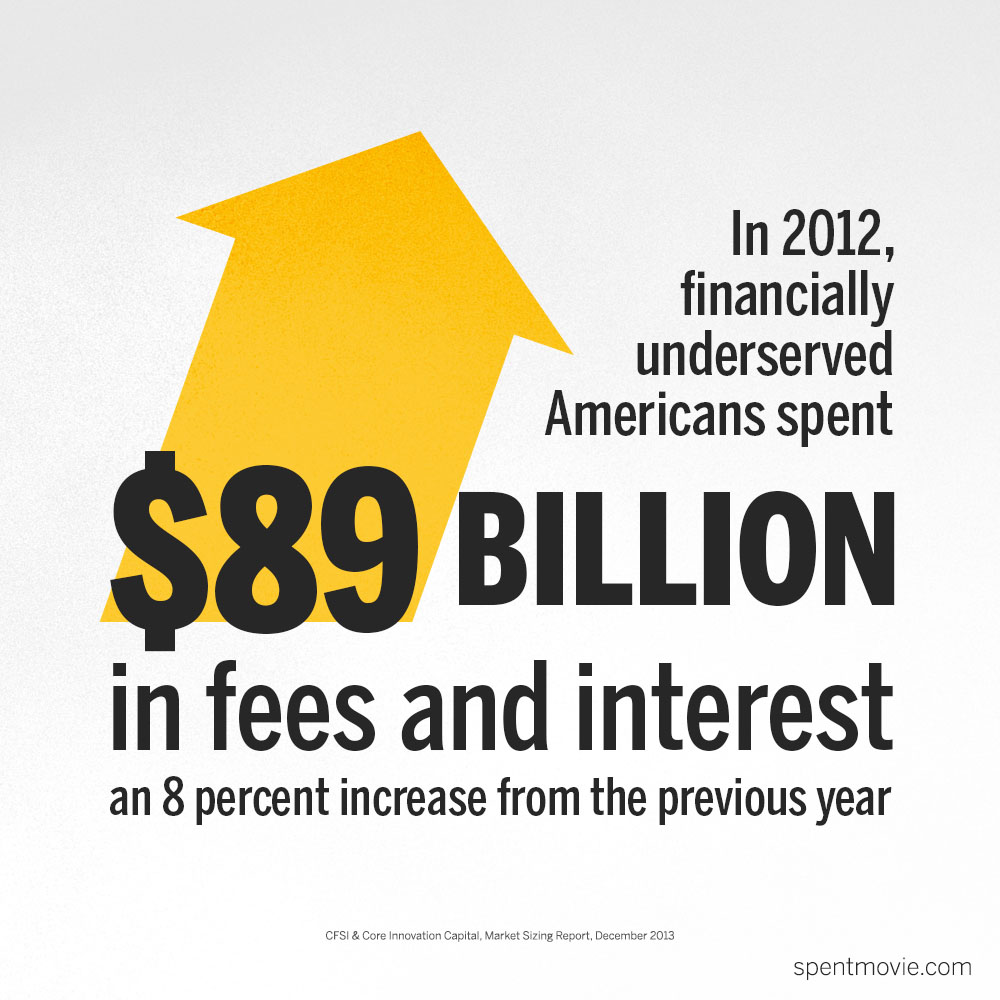

In 2012, these financially under-served Americans paid $89 Billion in fees and interest! Yes that’s a B for Billion. That’s just crazy.

I’m not going to bash the credit system because it works for most people, but I don’t think that it should be the only system to go by. There has to be a better way and this film is a great way to get the conversation started.

Many people think, myself included, that people get themselves in these types of situations, but this film shows us it could happen to just about anybody. In this film, Jonathan Mintz – CEO of Cities for Financial Empowerment Fund says,

The picture of the financially unstable is a picture of you and me, but for a couple of breaks.

The one thing that we can all do to prevent this is to educate ourselves. Here are the must-read personal finance books. Most of these situations could have been avoided if the people in this film knew what to do.

I really don’t understand why personal finance classes are not taught in our schools. If I had learned in school just half of what I know now, I would have never gotten myself into financial trouble.

[It has come to my attention that there is a Spent: Looking for Change worksheet and/or a Spent: Looking for Change quizlet for a class. If you have any information of what or where this class is, please comment below and I will promote it here.]

If you haven’t yet, please watch Spent and spread the word. Share it with everybody you know and together we could prevent somebody from making similar mistakes.

Know someone who needs to see this documentary? Share this article with them using the share buttons below. And don’t forget to save it for later on Pinterest:

[This article uses images obtained from spentmovie.com]

I have to say I really want to watch this documentary now! I walk from my garage to my building in downtown Cleveland every day, and along the way I pass by a payday lending store that always has a few people in line. It’s sad and disheartening. Definitely a bad cycle.

You should definitely check it out, Natalie. It is only 40 minutes and is very good.

Thanks for the great recap! I have not had a chance to watch the movie yet, but it sounds worthwhile. All it takes is one negative thing to happen to really ruin a person’s credit. I don’t look down on others who are in those types of tough financial positions, because you just never know their whole story.

You’re right Lauren, one little mistake and our credit is ruined for a long time. I also learned not to judge people because you just never know what they’re going through.

I love documentaries so I really want to watch them now. It’s easy to judge people who take out payday loans and go unbanked, but as you pointed out, it is sometimes the only option people have.

This is one is good Holly. Take a break from hustling, grab a glass of wine, and relax for 40 minutes.

Sounds like an interesting documentary. There are people living vastly different lives purely based on financial means, and it’s often invisible to others. If 70 million don’t have access to what many take for granted, it’s like a silent but sizable portion of the population that the rest doesn’t understand. Thanks for sharing!

True. I, for one, had no idea it was this many people. I was really surprised.

That is really sad that 2 of those 4 cases were due to health situations. But for the grace of God go I. Thanks for the recap, Aldo. I have 4 Pay Day Loan places within 2 kilometers of my home in a nice suburban neighbourhood. What’s wrong with that picture?

Yes Debs, it is sad and scary because we really have no control over those circumstances. There’s a pay day loan/check-cashing place by my house and I saw people waiting in line on Friday. And at first I thought it was because they were bad with money, like I was, but now I just don’t know what their lives is like. I’m glad I took control of my finances before I got to that point.

This was a great summary. I haven’t had the chance to watch it yet, but it’s upsetting how things can get in the way when you’re doing everything right, especially with the two that experienced health-related problems. It’s really unfortunate that people have to resort to payday and title loans just to get by for the week/month – they don’t have the luxury of thinking long-term as they have immediate needs.

You’re right. Sometimes people have no other option.

I will watch the movie as I love financial documentaries. I have park avenue on the netflix que as my next film to watch, have you seen that one? Being a PF blogger we are doing the best we can to change the financial lives of our readers.

I haven’t watched Park Avenue, but I’ll add it to my queue. If you know of more documentaries and/or movies I should watch please share.

I heard about this documentary and it sounds fascinating! I always wonder about who gets payday loans and why. I know there are many people who “live outside” the traditional banking system and I always just assume it’s illegal immigrants or something, but there really are a number of different people who fall into this category.

I thought the same thing, Shannon. But this is yet another example of why I should never assume. Now when I see people in those pay day loans places, I won’t know what to think.

Trying to make an actual difference in this space is part of the reason I love my job so much! After seeing the documentary Paycheck to Paycheck the MagnifyMoney team actually went down to Chattanooga, TN to host financial seminars and one-on-one workshops at the Chambliss Center. I’m so glad AMEX came out with this documentary. I hope it overviews the ChexSystems too. I’ll have to watch it later tonight!

Interesting, Aldo!! Having been a mortgage sales assistant for 5 years, I don’t wonder if part of Justin’s problem is that he is self-employed. Often small biz owners work to make their tax burden as light as possible with deductions, but then their bottom line taxable income looks especially small, making them ineligible for mortgage and other loans due to an inflated debt-to-income ratio. I saw this happen hundreds of times while working during the mortgage boom.

I love these kinds of docs. Kind of unrelated but on the subject of frugal, I just watched a doc on netflix called Tiny about a couple building a tiny house. It’s pretty cool!

I just added Tiny to my queue. At first I thought you were going to say Tiny Furniture, which is a movie with the girl from Girls.

Great write up – i’m definitely going to check out that documentary. The most unsettling is the nurse. You’d think that would never happen to someone with such a solid job (especially nursing) and such a strong nest egg.

I agree that personal finance classes in schools really couldn’t hurt. I mean, if we’re still teaching some stuff like home ec and shop, why wouldn’t we teach you how to balance a check book and what credit scores are and how interest works??