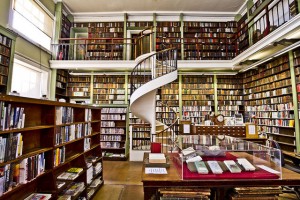

Yet Another Reason Why I Love The Library

Not My Local Library

Before I get into why I love the library, let me start by welcoming you to 2016!

I hope you had a great 2015 and an awesome time on New Year’s Eve. Kate and I were planning on just staying home and having a relaxing night, but our friends Chris and Kris told us they were going to Queens to their friend’s place and have a very low key new year’s eve reunion, then we decided to join them.

Our night was low key, but it was pretty awesome. We had some drinks, ordered some food, played board games, and spent some time with good friends. It was a great night overall.

We stayed over in Queens and had to wake up early on New Year’s Day so we can go to my mom’s house and have brunch with the family. After brunch, my brother, his wife, my brother in law, and I went to the 1:00pm show of Star Wars. My favorite part of Star Wars was when… just kidding – no spoilers.

I hope you also had a great New Year’s. Now it’s time to set the alarm clock because it’s back to work time… sad face.